Smart Money

How do title loans work in Illinois? | Yendo Credit Card

Yendo

May 10, 2023

|

3

min read

Are title loans legal in Illinois?

Yes, title loans are legal in Illinois - they are capped at an annual percentage rate (APR) of 36%. They are regulated under the Predatory Loan Prevention Act. [1] [2]. It's worth noting that in some states title loans are illegal. They generally come with high interest rates (291%, for example) and can get a customer into a cycle of debt.

Here's how title loans work in Illinois

In Illinois, title loans are a type of short-term, high-interest loan that uses the borrower's vehicle title as collateral. Here's how title loans work in Illinois:

- Borrower Eligibility: To be eligible for a title loan in Illinois, a borrower must be at least 18 years old and have a lien-free vehicle title in their name. The borrower must also provide proof of income and residency.

- Loan Application: Generally, borrowers need to fill out an application with a title loan lender, either online or at a physical location. The application typically requires personal information and details about the vehicle, such as its make, model, year, and mileage.

- Vehicle Appraisal: The lender will appraise the vehicle's value to determine the maximum loan amount they are willing to offer. In Illinois, title loan amounts can be up to $4,000, depending on the value of the vehicle and the borrower's ability to repay the loan.

- Loan Agreement: If the borrower agrees to the loan terms, they will need to sign a loan agreement. Generally, this agreement will outline the loan amount, interest rate, fees, and repayment schedule.

- Funds Disbursement: Once the borrower signs the loan agreement, the lender will provide the loan funds. In return, the borrower will temporarily hand over their vehicle title to the lender as collateral.

- Repayment: Generally, the borrower must repay the loan according to the terms specified in the loan agreement. In Illinois, title loans have a maximum term of 180 days. Payments typically include both principal and interest.

- Retrieving the Title: Once the borrower fully repays the loan, the lender will return the vehicle title to the borrower. If the borrower cannot repay the loan or defaults on the loan, the lender has the right to repossess the vehicle and sell it to recover the outstanding loan balance.

It's essential to note that the Illinois Predatory Loan Prevention Act, which went into effect in 2021, impacts title loans in the state. The law caps the annual percentage rate (APR) on title loans at 36%. This new regulation aims to protect consumers from predatory lending practices and high-interest rates associated with title loans.

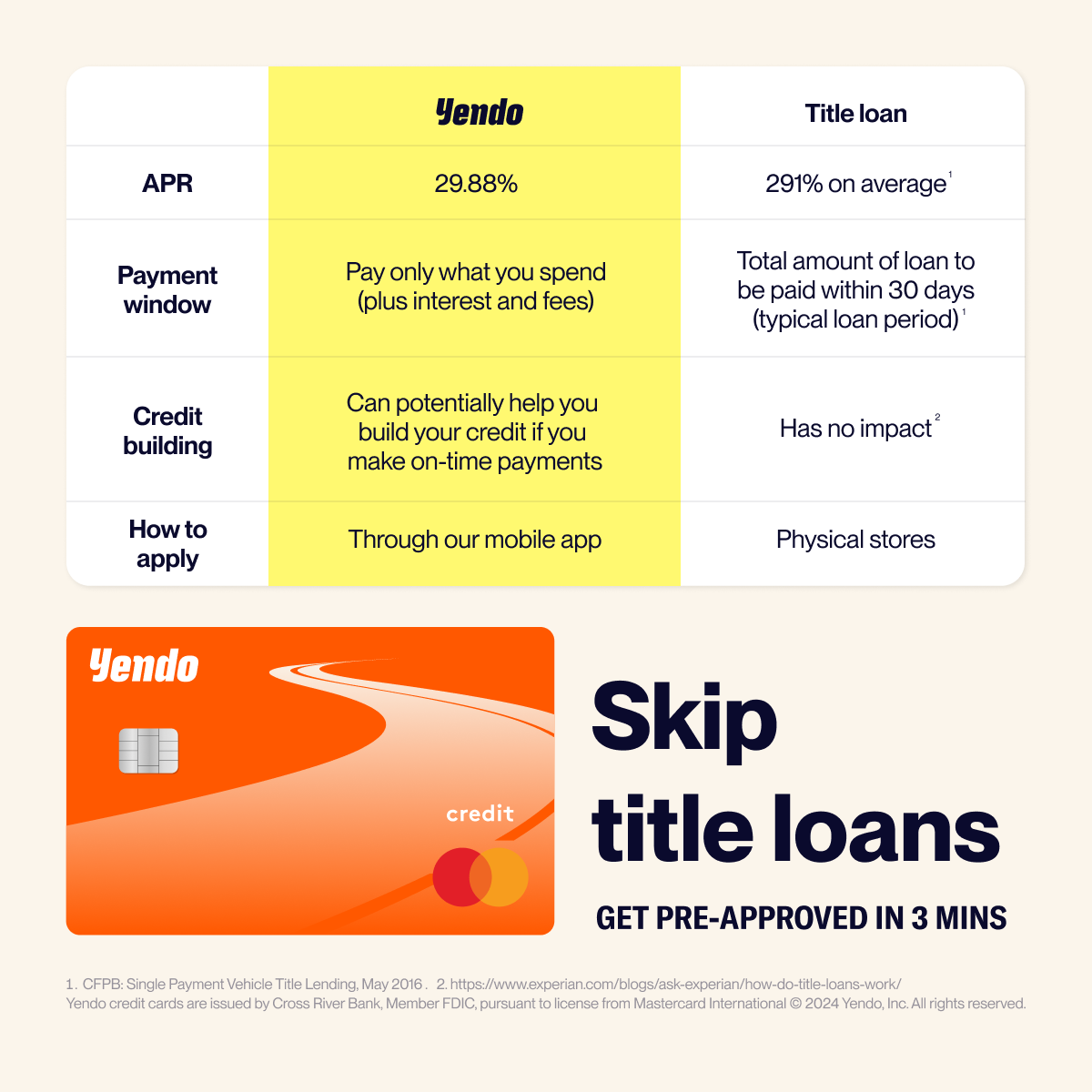

Compare Yendo versus a Title Loan

The Yendo credit card that is secured by your car title, or the car you're still making payments on, is significantly cheaper compared to a title loan:

The Yendo Card - The Title Loan Alternative

Yendo is the first credit card that's backed by the value of your car, so you can use your car title to get a credit line of up to $10k.

The card can provide access to credit for those who might not be able to qualify for other credit cards. It's a real credit card, powered by Mastercard, that provides credit limits from $450 - $10,000, depending on the value of your car.

So, rather than re-applying for loans, for example, you can access funds an ongoing basis and, with responsible usage like on-time payments, build your credit too.

Features & benefits of the card

- Credit limit - access up to $10k in credit

- Only pay for what you spend - it's a credit card, so you only pay for what you spend, plus interest and fees. Or, if you pay off your balance each month, you only pay for what you spend.

- App - the Yendo app lets you manage your account, wherever you are

- Virtual card - access a portion of your credit limit prior to getting your physical card in the mail with the Yendo virtual card. Use your virtual card in addition to your physical card

- Cash advances - ability to do cash advances on your card if you need to access money quickly

- Access to revolving credit – you’ll have a revolving line of credit that opens up as you make payments

- Credit reporting – all your account activity will be reported to the credit bureaus, giving you the perfect opportunity to build your credit

Disclaimer: Yendo is not a provider of financial advice. The material presented on this page constitutes general consumer information and should not be regarded as legal, financial, or regulatory guidance. While this content may contain references to third-party resources or materials, Yendo does not guarantee the accuracy or endorse these external sources.

Additional information

Citations

- https://www.ilga.gov/legislation/ilcs/ilcs5.asp?ActID=4088&ChapterID=67

- https://www.cnbc.com/2021/03/23/illinois-governor-signs-off-on-law-capping-consumer-loan-rates-at-36percent.html

Links

- https://illinoisattorneygeneral.gov/Page-Attachments/PredatoryLoans.pdf

- https://www.luc.edu/law/stories/our-stories/illinois-predatory-loan-prevention-act-paul-kantwill/

- https://www.consumerfinance.gov/about-us/newsroom/cfpb-orders-titlemax-to-pay-a-10-million-penalty-for-unlawful-title-loans-and-overcharging-military-families/

- https://www.propublica.org/article/how-title-loans-work

Disclaimer: Yendo is not a provider of financial advice. The material presented on this page constitutes general consumer information and should not be regarded as legal, financial, or regulatory guidance. While this content may contain references to third-party resources or materials, Yendo does not guarantee the accuracy or endorse these external sources.