Smart Money

How do title loans work in Georgia? | Yendo Credit Card

October 10, 2023

|

4

min read

Are title loans legal in Georgia?

Yes, title loans, or title pawns as they're also known as in Georgia, are legal. Under Georgia law, the lender can charge interest on the loan amount, but there is a limit on the total amount they can charge. The state also requires title loan lenders to be licensed and to provide specific disclosures to borrowers.

What are the interest rates for title pawns in Georgia?

According to Georgia law:

...the interest rate such companies are allowed to charge is capped by law at 25 percent monthly (300 percent annually) for the first three months and 12.5 percent monthly after that (150 percent annually). This means a combined maximum yearly interest rate of 187.5 percent. [1]

How do title loans work in Georgia?

Title loans in Georgia work by using your vehicle title as collateral for a short-term loan. The amount of the loan is determined by the value of your vehicle.

Here are the steps involved:

- Application: You begin by filling out an application. This can often be done online, but some lenders allow or require you to apply in person. You'll typically need to provide information about yourself, your vehicle, and your financial situation.

- Vehicle assessment: After your application is received, the lender will assess your vehicle's value. This is usually done by looking at the make, model, year, condition, and mileage of your vehicle.

- Loan offer: Based on the value of your vehicle and your ability to repay the loan, the lender will make a loan offer. The loan amount will typically be a percentage of your vehicle's value.

- Agreement: If you agree to the terms of the loan, you'll sign a loan agreement. This document will outline the loan amount, interest rate, and repayment schedule, among other things.

- Disbursement: Once you've signed the loan agreement, you'll receive your funds. The lender will keep your vehicle's title until the loan is repaid in full.

- Repayment: You'll need to repay your loan according to the terms outlined in your loan agreement. Some lenders may offer extensions if you're unable to repay your loan on time, but additional fees may apply.

- Return of title: After you've repaid your loan in full, the lender will return your vehicle's title to you.

Risks and Alternatives to Title Pawns

One of the significant risks associated with title loans is the possibility of losing your vehicle if you fail to repay the loan.

If you cannot make the payments, the lender can repossess your vehicle, sell it, and keep the proceeds to cover the amount you owe and any associated expenses. To avoid such a situation, consider alternatives to title loans, such as:

- Negotiating a payment plan with the seller or provider of the service or product you need the loan for

- Contacting a credit counseling service for financial advice and assistance

- Borrowing from friends or family

- Seeking financial help from a charity or government agency

- Applying for a Yendo vehicle secured credit card

The Yendo Card - The Title Loan Alternative

Yendo is the first credit card that's backed by the value of your car, so you can use your car title to get a credit line of up to $10k.

The card can provide access to credit for those who might not be able to qualify for other credit cards. It's a real credit card, powered by Mastercard, that provides credit limits from $450 - $10,000, depending on the value of your car.

So, rather than re-applying for loans, for example, you can access funds an ongoing basis and, with responsible usage like on-time payments, build your credit too.

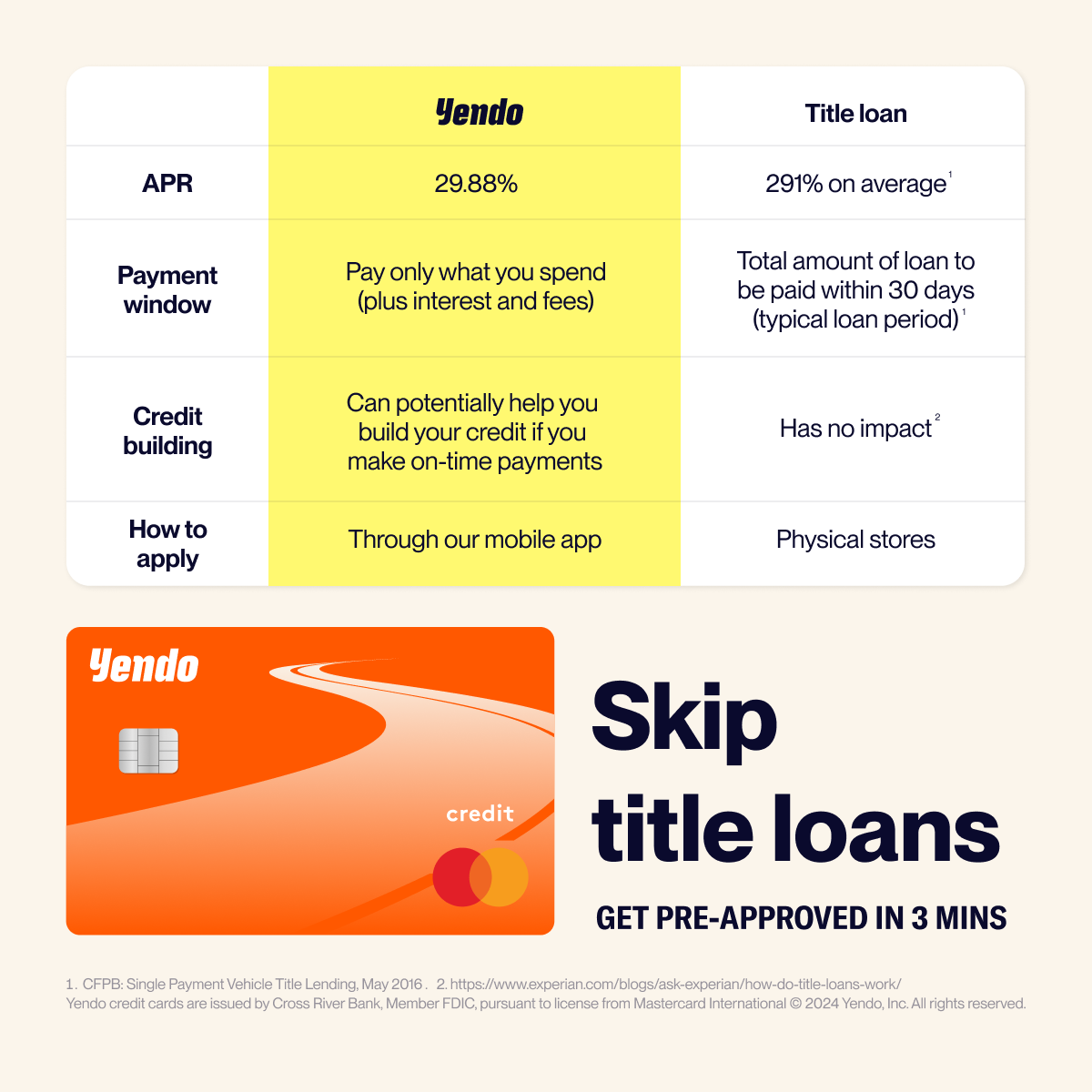

Compare Yendo versus Title Loans / Pawns

Features & benefits of the card

- Credit limit - access up to $10k in credit

- Only pay for what you spend - it's a credit card, so you only pay for what you spend, plus interest and fees. Or, if you pay off your balance each month, you only pay for what you spend.

- App - the Yendo app lets you manage your account, wherever you are

- Virtual card - access a portion of your credit limit prior to getting your physical card in the mail with the Yendo virtual card. Use your virtual card in addition to your physical card

- Cash advances - ability to do cash advances on your card if you need to access money quickly

- Access to revolving credit – you’ll have a revolving line of credit that opens up as you make payments

- Credit reporting – all your account activity will be reported to the credit bureaus, giving you the perfect opportunity to build your credit

Additional information

Citations

- https://consumer.georgia.gov/consumer-topics/title-pawns-and-cash-advances

- https://dbf.georgia.gov/pawnshops-title-pawn

Title loans in the news

- https://www.consumerfinance.gov/about-us/newsroom/cfpb-sues-usasf-servicing-for-illegally-disabling-vehicles-and-for-improper-double-billing-practices/